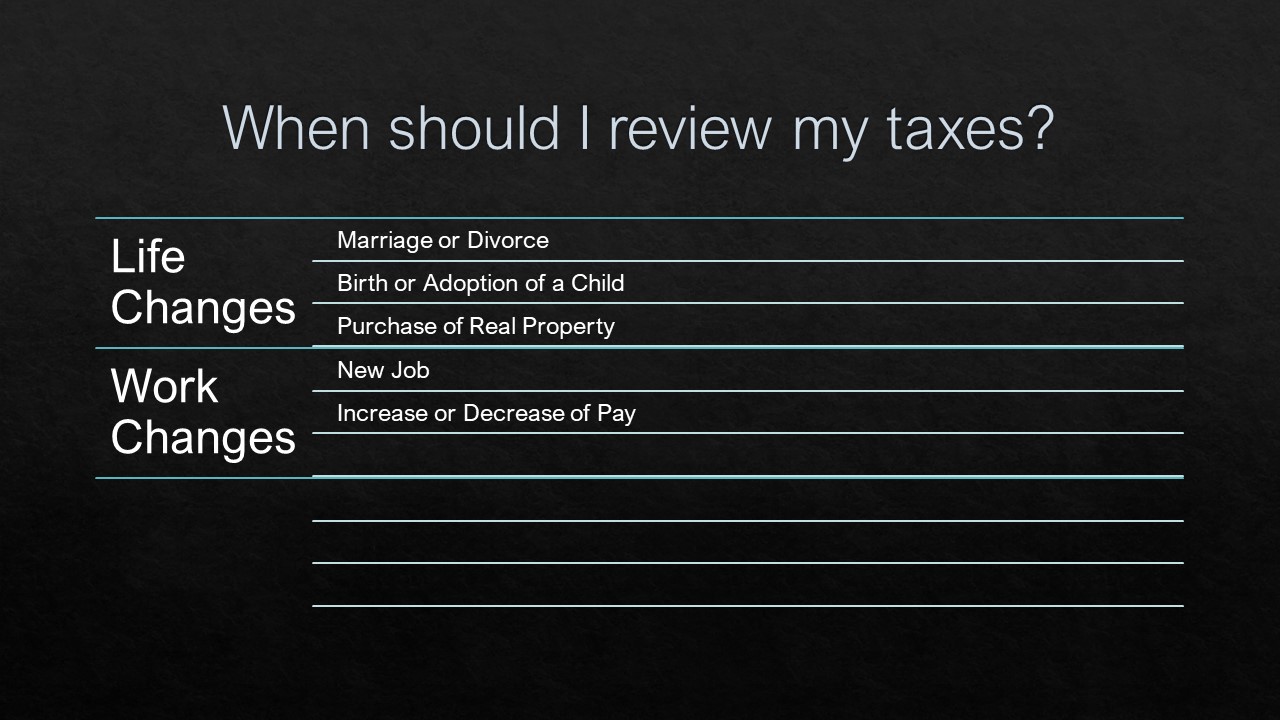

Income tax planning is something that everyone should think about when there are changes in your life that have an impact on your income and taxes. It is important to keep up on your tax status to avoid any surprises when it comes time to file your income taxes.

Here are a few of the categories you should think about looking into your tax situation:

Life Changes

- Marriage or Divorce – this has a large impact on your taxes, its important to consider the changes to income level and property owned when one of these occurs

- Birth or Adoption of a Child – another important change to your tax status, there are tax credits to consider as well as adjustments to taxes withheld from your paycheck.

- Purchase of Real Property- this is usually a home or other large item that holds value over time. It is important to be sure you are getting all of the deductions that are due to you.

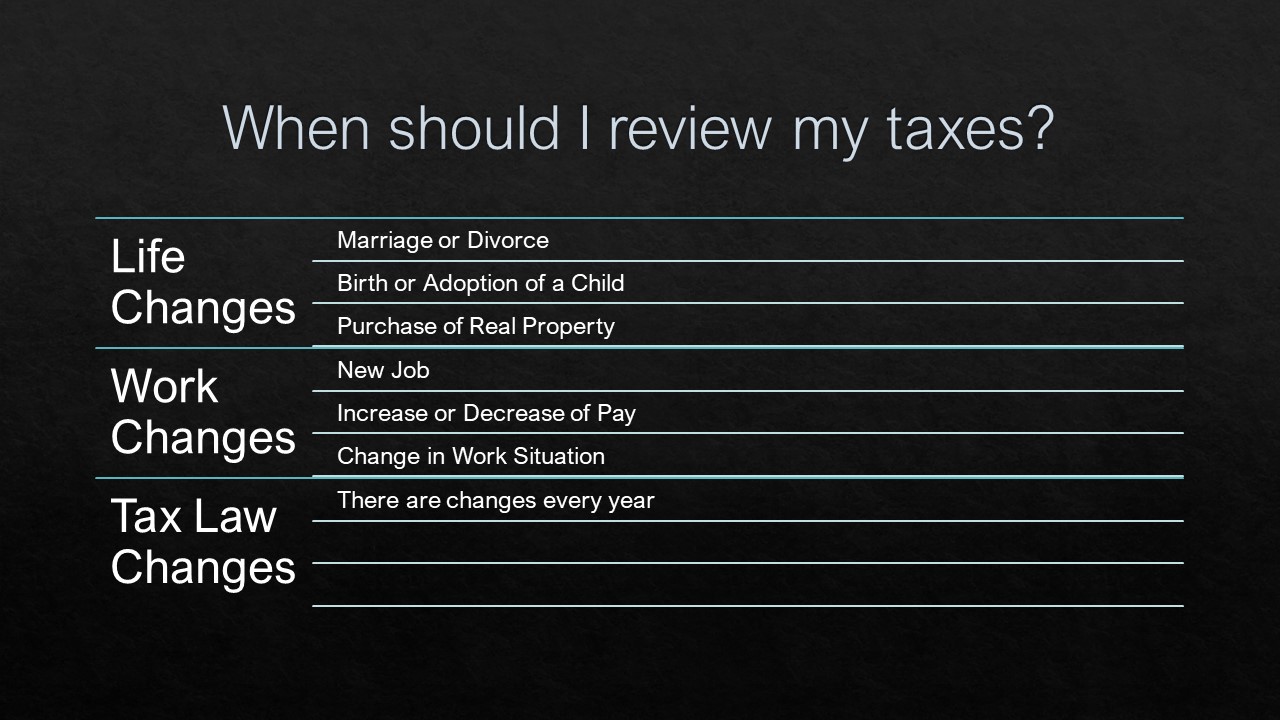

Work Changes

- Starting a New Job – you will be filling out a new W4 form with your new employer and you should always review your tax status before completing the form, you should also consider any pre-tax benefits your new employer offers at this time as well.

- Increase or Decrease in Pay – obviously, a change in your income level has an effect on your tax status. A slight increase in pay could put you into the next tax bracket so it is important to review your situation when this occurs

- Change in Work Situation – Are you now working remotely? Have you switched from being an hourly employee to salaried? It’s important you review your status when these things happen, in the past you have been able to deduct unreimbursed business expenses, but this deduction has been taken away in 2018.

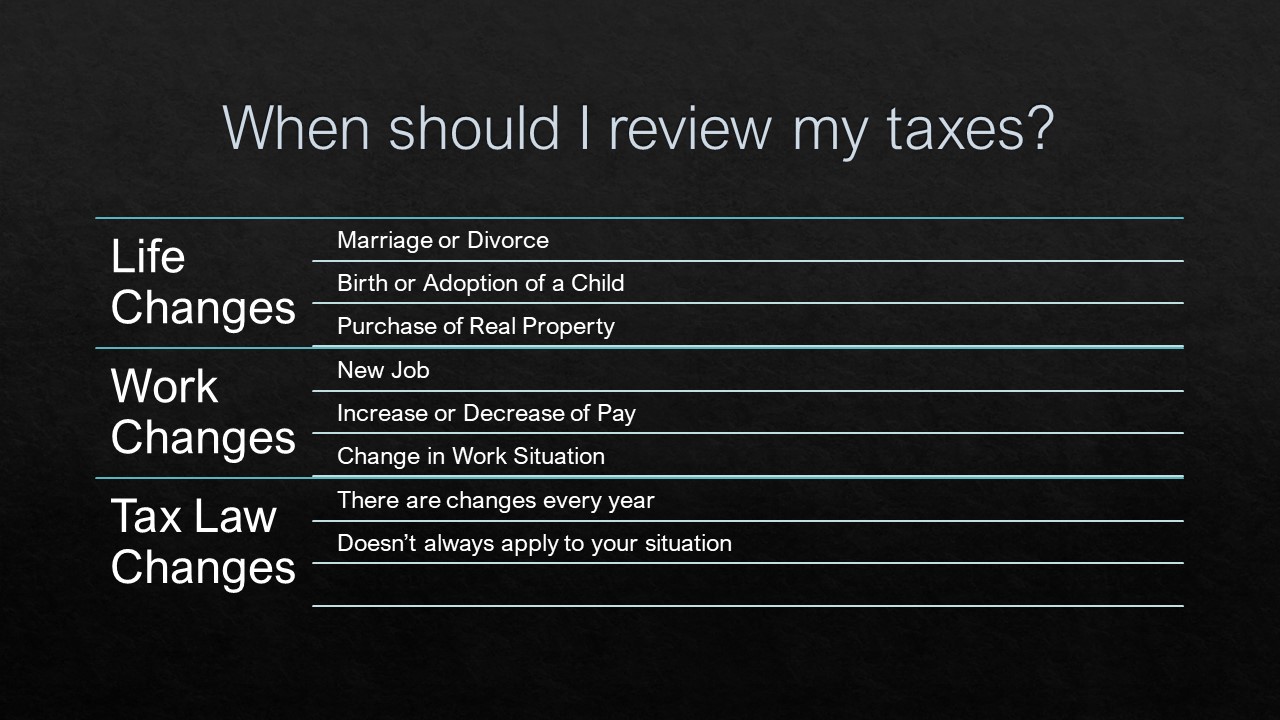

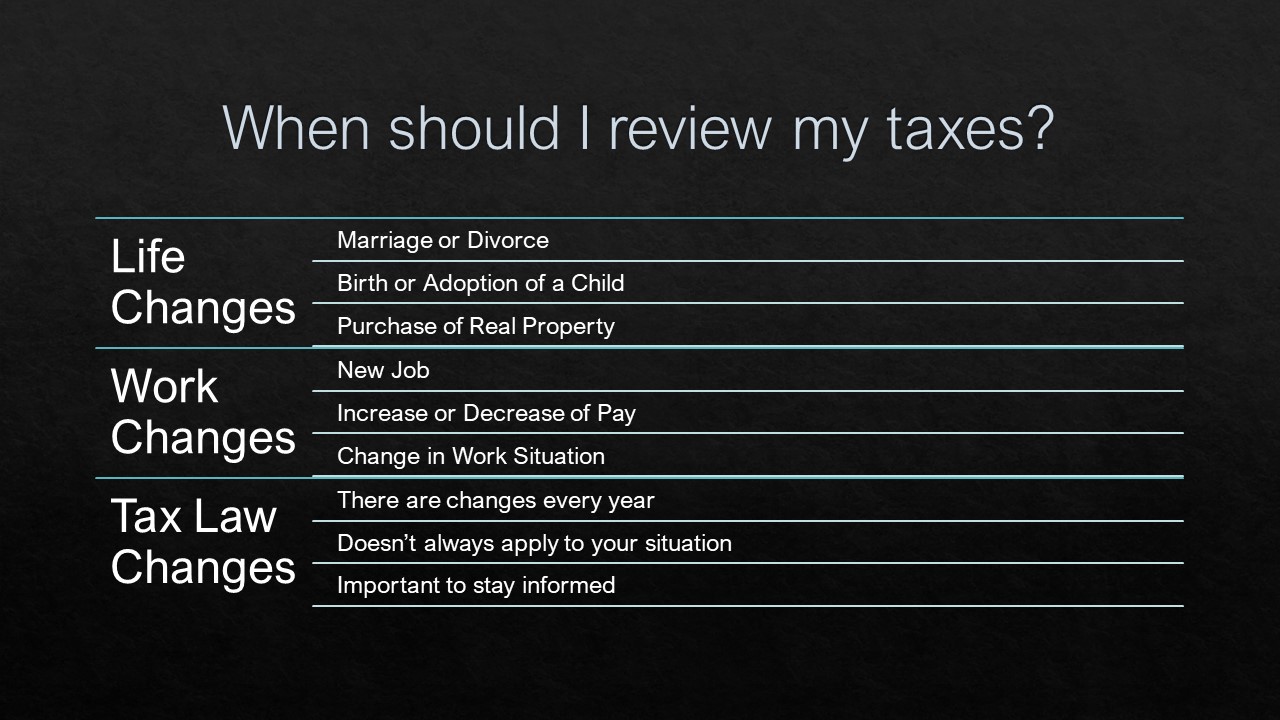

Tax Law Changes

- It is always important to keep up on legislation that is passed to make sure your tax status is up to date. There are usually small changes every year, and most of the time they don’t apply to most of the population. It is usually the major tax law changes that get the publicity, but if you keep up on it, you may find that there was a change you can make that will save you on your taxes.

Where can I get help if I need it?

- Contact your tax professional- if you have a CPA or tax preparer do your taxes every year reach out to them; they understand your tax situation and can give you the guidance you need.

- Online Tax Prep Companies – if you use Turbo Tax or H&R Block or a similar service, they have resources you can use year round and they are pretty good about sending out email throughout the year to remind you to review your tax status

- IRS website- This is the most comprehensive tool you have; they have calculators and publications for every tax question.

Hopefully the above tips will be useful in your tax planning in the future. While I am not a tax professional, I hope this will raise your awareness about your income tax status and if you have a specific tax question please reach out to a tax professional.

Mark Wittwer is CFO of Diamond Media Solutions

No Comments